Let’s Keep it Local!

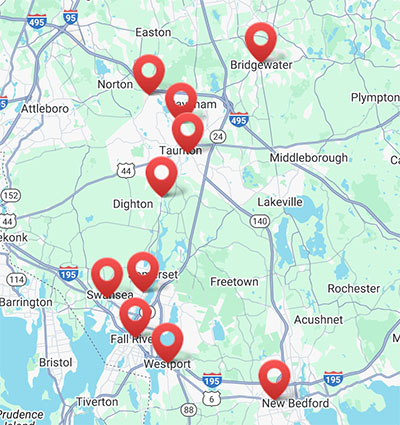

Our Market Area

Keeping it Local!

At Mechanics Cooperative Bank, Let’s Keep it Local!® is more than a tagline – it’s a mindset rooted in the values of our founders and the communities we serve. From day one, this movement has reflected a simple belief: when you invest in your neighbors, everyone thrives. Whether it’s choosing a small business over a chain, volunteering for a school fundraiser, or banking with a community driven institution, every local decision builds momentum.

We’re proud to champion that movement – not just through the work we do, but through the relationships we’ve built across the Southcoast. Our team lives here, works here, and shows up for the people here. That’s what keeping it local really means.

About the Movement

The Let’s Keep it Local!® philosophy was created by the people of Mechanics Cooperative Bank – not just as a campaign, but as a commitment. Our leadership team, many of whom grew up in the same neighborhoods we serve today, saw firsthand the difference that local banking can make. Their vision? To create a modern bank that feels personal, responsive, and rooted in the community.

Over a decade later, this vision still guides us – and the movement continues to grow, one connection at a time.

Cup of Joe

In 2025, we launched Cup of Joe, a video series hosted by Presiden & CEO, Joseph T. Baptista Jr. In each episode, Joe shares his personal insights and updates on local initiatives and the ever-changing financial industry.

Whether you’re a longtime customer or just getting to know us, this is a great way to stay connected with what’s happening, here at Mechanics!

Get caught up now on all episodes and stay tuned to our socials to catch the next one as soon as it drops! Link to video: Cup of Joe Video Series

Deposit Insurance Fund (DIF)

All DIF member banks are also members of the FDIC. All deposits above the FDIC insurance limit are insured by the Depositors Insurance Fund (DIF). The combination of FDIC and DIF insurance provides customers of member banks with full deposit insurance on all their deposit accounts.

No depositor has ever lost a penny in a bank insured by both the FDIC and the DIF.

To learn more about the DIF’s history, operations, and deposit insurance coverage, please visit the DIF’s website at www.difxs.com and click on the FAQ link at the top of this page or call the DIF at 781-938-1984.

Need help with your account?

Give us a call!

Connecting all branches: 1-888-MECHANICS (632-4264)